Scaling your UK recruitment business in the US: a perspective from global agency, PGC Group

The Recruitment FDs network hosted a live event where Amy Davies, MD at PGC Group, talked about how to enter the US market. As experts in this field, the PGC Group has a lot of valuable insight and data to help recruitment firms to successfully grow their businesses into the US. We were lucky enough to be provided with some of this insight, which we're happy to share in this article.

Below you'll find a shortened transcript of the key points from Amy's presentation. This'll give a good starting point if you're considering entering the US market in 2023...

If you prefer to watch and listen rather than read an article, sign in or sign up to the RFDs network, and you can access the full recorded presentation in the member’s area.

Speaker: Amy Davies, MD at PGC Group:

Who are PGC Group?

PGC Group are an Employer of Record, supporting recruitment agencies in engaging contractors in all 50 states of the US. We've got a turnkey solution. We have supported clients over 22 years' in expanding into the US.

Speaking specifically to heads of finance within UK recruitment businesses: when thinking about entering the US market, you're probably thinking, 'how do I do this compliantly, and how do I mitigate risk?'

What size is the US staffing market?

The US has a 31% market share globally for staffing - around 186bn dollars. Japan comes second at 16%. The UK comes in third at 8% global market share.

The US market is three times bigger than the UK. Looking at the data above, we can see how much less saturated the US market is than the UK.

You can also see the margins are much higher for the US. Salaries are much higher there.

The average margin for permanent roles is about 28%. For contract it varies from 25% - 45%. Pre-pandemic, 45% would be for hard to fill for niche roles, but post-pandemic it's around 35% for roles that were not historically considered hard to fill or niche - because of this demand for talent. In the UK it's around 15% - 25%.

The market opportunity in the US:

One of the main reasons UK recruiters love the US is that US recruiters are seen as professionals - and are a necessity to any business.

Something that drives the view of the necessity of employment in the US is 'at will employment.' This is essentially the ability of the firm to dismiss the worker without notice and without pay - and without reason. The worker is able to do the same. The worker does not have to tell the employer they've left - they can just walk out, essentially. This means a very transient market as you can see. For recruiters, this means that businesses may need support at short notice. Recruiters will often upsell contractors while they find the permanent member of staff. This is why we see that recruiters are valued.

Many agencies have done well by using their existing operational costs to test out in a new market - building out their US book from the UK. Often they'll make the most of UK clients who have US offices to build out the organic opportunity. Once it's built to a certain level, they'll look to land and expand.

The other reason to enter the US market as a recruiter...

When looking to the future to exit, if you can demonstrate competency and capability in the US market - and if you have a presence there and can demonstrate capability when it comes to both parent contracts - it leads to a higher multiple when it comes to evaluation or an exit event. This is a main driver for expansion.

So, what's it actually like to do business in the US?

The US market is incredibly strong and it's still projecting growth this year. That's the good news. However, politically, the Republicans have just taken back the House of Representatives. (As a side note, don't talk about politics with US clients).

There is now the chance of new legislation further down the line. This impacts recruiters both for perm and contract roles. And of course, the 'r' word: recession. Roles are taking longer to fill. However, there are still roles out there...

To give some context, the three indicators of a recession are: 1) job gains 2) industrial production and 3) retail sales.

In the US, across all three indicators there is strong growth, and the best performance globally.

Inflation is cooling, but the fed is continuing to raise interest rates. There were seven increases throughout 2022, and we're expecting more in 2023.

Obviously there have been loads of tech layoffs as well. We've seen that a lot of businesses have over-hired, so what we're seeing now is a rebalancing of the scales, in terms of what big businesses need post-pandemic, in order to grow. With the SME market however, there's phenomenal growth in the hiring market, particularly in the tech sector.

The FT reported that pre-pandemic, one in 10 people were contractors. Now it's one in five.

By 2027, it's predicted that up to 50% of the US workforce will be contingent in some form or another. So, people worrying about spending money is leading to an increase in contractors. Also, culturally, because of at-will employment, there’s not a huge difference between permanent staff and contractors, so you do find people switching between the two.

The US employment market:

Last year is the second strongest year on record for the US employment market.

Unemployment rate is now back at pre-pandemic levels – but there are more jobs than pre-pandemic.

What we found with our own research is that a lot of people post 60 years’ old, didn’t go back to work post-COVID. It’s because of this that the industry has suffered in terms of filling roles in this post-pandemic boom.

Where do I set up in the US?

Highest recruitment revenue per state:

You need to think about the US as 50 countries. You can see in the visual, that the top right box shows the states with the highest total revenues coming from recruitment. This is for perm roles.

During the pandemic several states introduced corporate incentives to encourage businesses to move there. For Texas the state corporate tax is zero for example. As such, many businesses moved out to these low or no-tax states. This is certainly something to consider when you’re looking for your US HQ.

The bottom right of the visual above refer to temp contractors. There’s a slight variation. The reason this is different is because of the way that tax is paid in the US. For a contractor, the revenue is counted where the contractor is carrying out the work. Whereas if it’s a perm, it’s where the revenue is being generated from, which is the business where you’re placing the worker.

It’s good to see the split because you can see both where the companies are that are generating the revenue – but also where the talent is. It’s not necessarily in the same state.

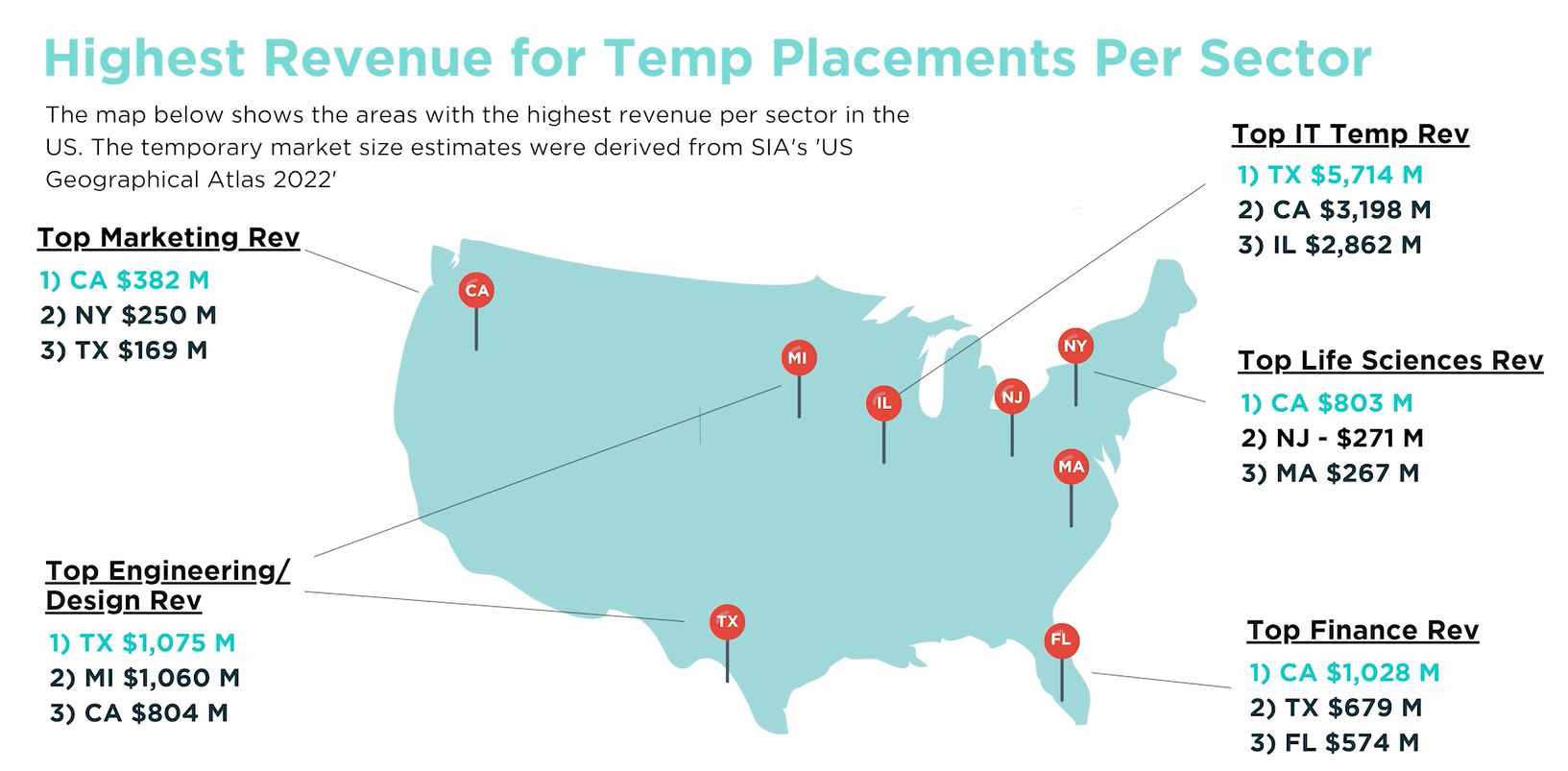

Highest revenue for temp placements per sector:

This covers the most common sectors.

Per above, we’ve seen a massive growth in marketing and creative roles over the last 18 months…

So, how do we get a piece of the American pie?

One thing to think about is how tax legislation and culture actually works in practice. You’ve got federal law and taxes, state taxes and legislation. They can’t take away federal legislation. They enhance it. Every state does this. So, just because you do business in one state it doesn’t mean it’s going to be the same, or reported the same from one state to another – or even that you’ll pay the same tax. In the larger states e.g. California, they’ll have a local government. Potentially you’re dealing with three layers… so, it can be complex to do business in the US. You need to think small if you’re going to the US. Think about what state and where in the state you’re going to go. There are huge economies within each state. You then start to drill into reasons and drivers for each location.

Differences between the UK and US:

If the above has whet your appetite to find out more, see the full video with even more insights in the member’s section of the site.

Lastly, we finish off this article with the following quote:

Thanks for reading!