UK Economy Review

RSM UK’s economist, Tom Pugh, examines the economic trends behind market conditions impacting the recruitment sector.

CPI Inflation

We anticipate inflation will continue to fall over the rest of this year. It will likely reach 9% in March – as the fall in commodity prices and shipping costs over the last six months works its way through to prices for food and core goods – and reach around 2% by the end of the year.

Wholesale prices suggest that the CPI inflation rates for electricity and natural gas will slump to about -10% by the end of the year, from their 65% and 129% rates in January. The stabilisation of global agricultural commodity prices over the last six months suggests that food CPI inflation will fall to about 2.5% by the end of this year, from 16.7% in January.

UK recession

The UK has avoided falling into recession by the skin of its teeth, but the worst is yet to come. There are clear signs that the economy has deteriorated over the last few months; GDP fell by 0.5% in December after growing by 0.1% in November. The combination of double-digit inflation, the huge rises in interest rates over the last year and less fiscal support means households real disposable incomes are set to shrink sharply in the first half of this year. That will lead to falling consumer spending and a shrinking economy. As a result, we think the recession has just been delayed, rather than totally avoided.

Of course, narrowly avoiding a recession doesn’t change much on the ground. But a milder recession would mean that unemployment rises more slowly, wage growth stays strong and domestically generated inflation falls at a slower pace than expected. This could result in the Bank of England (BoE) raising rates by more than expected.

We continue to think that GDP will drop substantially in Q1 and Q2. The Government has temporarily stopped paying cost of living grants to low-income households in Q1 and will substantially reduce its energy price support in Q2. What’s more, consumer confidence is still near record lows, which will prevent households from lowering their still high saving ratio.

Meanwhile, the Monetary Policy Committee’s rapid rate hikes have dramatically increased the cost of external finance for corporates, who mainly have floating rate loans.

However, the recession we expect in the first half of 2023 will be mild by historical standards. We expect this recession to see a peak-to-trough drop in GDP of roughly 1%. That would be roughly half the size of the early 1990s recession, significantly smaller than the Global Financial Crisis (which had a peak-to-trough drop in GDP of around 6%), and a fraction of the pandemic, when GDP fell by a massive 22%.

Admittedly, the recent collapse in wholesale energy prices suggests that households’ real expenditure will be picking up in the second half of this year and dragging GDP up with it. But the big picture is that the economy could be no larger in 2025 than it was in 2019, before the pandemic.

Vacancies and unemployment rate

There are now some reasonably clear signs that demand for labour is starting to weaken. Vacancies continued to fall, dropping by another 76,000 on the quarter in December, the seventh consecutive fall. Most surveys of employment intentions suggest that vacancies will fall rapidly over the next few months.

However, at just over one million last month, job openings remain well above their pre-pandemic average. For now, it appears most firms are adjusting to weaker economic activity by putting hiring plans on ice, rather than making redundancies.

We expect vacancies to continue to fall sharply over the next year as firms reduce their demand for labour. The recession will also raise unemployment levels but, given the surge in the number of people on long-term sick leave significantly reducing the workforce, the unemployment rate is likely only to rise around 5%, a historically low figure, especially during a recession.

Employment

However, the big issue is still the huge number of inactive eligible workers –- those who have removed themselves from the workforce. Admittedly, inactivity levels have fallen slightly recently. But the inactivity rate was still near its recent high and the shortfall of workers compared with pre-pandemic levels remains sizable, at 280,000. What’s more, there were 843,000 working days lost because of labour disputes in December 2022, which is the highest since November 2011. It will be extremely difficult for economic growth to rebound strongly without getting more people into work.

Pay growth and inflation

The tight labour market means growth in regular pay (excluding bonuses) was 6.7% among employees in the three months to December 2022, up from 6.4% in November. This is the strongest growth in regular pay seen outside of the pandemic period – that is, miles above the 3% - 3.5% that’s consistent with the 2% inflation target.

However, it’s not quite as bad as it looks. Average regular pay growth, which the MPC cares more about, was stable at 7.3% and the single month measure dropped sharply in December, suggesting that momentum is waning. Pay growth has probably peaked now. The slowdown in hiring will lead to less churn in the job market, easing the pressure on businesses to pay more to retain staff. However, the Bank of England will want to see concrete signs of easing wage growth before they consider pausing the tightening cycle. That probably won’t be until Q2 this year as the labour market lags the real economy significantly. As a result, the MPC is likely to hike rates by another 25 bps in March, taking rates to 4.25%, where it will probably press pause.

Given soaring inflation, in real terms over the course of the year, regular pay fell by 2.5%, a near-record drop.

For further information and to discuss how this may impact your recruitment business, please contact: Neil Thomas

RSM provides unique insights to the UK’s Middle Market: Home Page - MMBI (rsmuk.com)

Take Advice, Take Control

Economic conditions remain challenging and many businesses built up significant debt in order to trade through the turbulence of the last few years. It is, therefore, unsurprising that the rate of business failure is rising, particularly amongst recruiters. Hallmarks of the industry, including tight margins and limited assets, often means that emergency borrowing is proving difficult to pay down and can feel like a significant burden.

It is natural for company directors to try and stay the course and seek to work through financial difficulties. However, this can lead a business down a narrow path and potentially towards a worst case scenario.

The key to finding the optimal solution, in any challenging situation, is to seek advice early and discuss the options available. A high quality restructuring professional will be happy to provide a director or board with free advice around potential solutions to financial pressure. This may include: refinancing or restructuring of debt, identification of loss making business elements to be closed and/or operational reorganisation. They will also be able to set out options, should the business need to be formally restructured through an insolvency process and discuss critical timings. This will ensure that stakeholders (including employees and customers) are best protected.

Advice can also be given around a directors duties and how to avoid a possible business failure resulting in personal claims against a director.

Timing is key. Taking early advice allows directors to take control of a challenging situations and identify an optimal route forward; protecting all involved, including themselves.

About RSM UK

We offer specialist services to recruitment businesses of all sizes. We have built up an understanding of their particular needs over many years working with the sector. We appreciate that companies operating in the recruitment market need advisers to fully understand the sector. Through their specialist commercial knowledge, our recruitment sector team can deliver real value to enable our clients’ businesses to thrive.

Learn more here: www.rsmuk.com

The Hidden Costs of Technology in Recruitment: Why CFOs and Finance Directors Need to Prioritize Contract Management

In today's world, technology has become an integral part of every business, and recruitment businesses are no exception. The use of technology can help streamline processes, improve efficiency, and enhance the overall customer experience. However, it's important to acknowledge that with the adoption of technology comes hidden costs that can quickly add up if left unaddressed.

As CFOs and Finance Directors of recruitment businesses, it's your responsibility to ensure that all costs associated with technology are accounted for and budgeted appropriately. This requires a deep understanding of the various systems and software used across the business, as well as a comprehensive contract management process.

One of the most significant hidden costs associated with technology in recruitment is the cost of unused or underutilized software licenses. With the rapid pace of technological advancement, it's easy to fall into the trap of continuously adding new software and tools without properly evaluating their impact and utilization within the business. In many cases, businesses end up paying for licenses that are never or rarely used, resulting in unnecessary expenses.

Another hidden cost is the cost of renewing software licenses and subscriptions without proper negotiation. Many software providers rely on automatic renewal clauses, which can result in businesses paying inflated prices without proper negotiation. This can be avoided by having a well-organized contract register that tracks all relevant contract details and renewal dates.

Furthermore, it's important to acknowledge the cost of integrating different systems and software across the business. While integration can improve efficiency and streamline processes, it can also be a complex and costly process. Integration requires careful planning, testing, and implementation, and it's important to evaluate the benefits against the cost before proceeding.

“Most recruitment businesses are spending on average 10% to 30% more than they need to on technology-related services.” Brad Dowden, Founder - Intercor

The importance of having a contract register cannot be overstated. A contract register is a centralized repository that contains all the relevant details of contracts and agreements, including renewal dates, pricing, and terms and conditions. This allows businesses to gain visibility over their technology landscape and track all associated costs. By having a contract register, CFOs and Finance Directors can make informed decisions when negotiating renewals or evaluating the cost-benefit of new technology.

To help you gain visibility over your technology landscape, we've created a free contract register template that you can download and use for your business. The template includes all the relevant fields and is the first step to unlocking savings and value for your business. By using this template, you can ensure that all contracts and agreements are properly managed and tracked, and hidden costs are minimized.

In conclusion, technology is an essential part of every recruitment business, but it's important to acknowledge the hidden costs associated with it. By prioritizing contract management and utilizing a contract register, CFOs and Finance Directors can gain visibility over their technology landscape and ensure that all costs are accounted for and budgeted appropriately.

About Intercor

We help recruitment businesses to leverage technology in order to increase profits and valuations, scale efficiently and optimise costs. Learn more at www.intercor.co.uk

Scaling your UK recruitment business in the US: a perspective from global agency, PGC Group

The Recruitment FDs network hosted a live event where Amy Davies, MD at PGC Group, talked about how to enter the US market. As experts in this field, the PGC Group has a lot of valuable insight and data to help recruitment firms to successfully grow their businesses into the US. We were lucky enough to be provided with some of this insight, which we're happy to share in this article.

The Recruitment FDs network hosted a live event where Amy Davies, MD at PGC Group, talked about how to enter the US market. As experts in this field, the PGC Group has a lot of valuable insight and data to help recruitment firms to successfully grow their businesses into the US. We were lucky enough to be provided with some of this insight, which we're happy to share in this article.

Below you'll find a shortened transcript of the key points from Amy's presentation. This'll give a good starting point if you're considering entering the US market in 2023...

If you prefer to watch and listen rather than read an article, sign in or sign up to the RFDs network, and you can access the full recorded presentation in the member’s area.

Speaker: Amy Davies, MD at PGC Group:

Who are PGC Group?

PGC Group are an Employer of Record, supporting recruitment agencies in engaging contractors in all 50 states of the US. We've got a turnkey solution. We have supported clients over 22 years' in expanding into the US.

Speaking specifically to heads of finance within UK recruitment businesses: when thinking about entering the US market, you're probably thinking, 'how do I do this compliantly, and how do I mitigate risk?'

What size is the US staffing market?

The US has a 31% market share globally for staffing - around 186bn dollars. Japan comes second at 16%. The UK comes in third at 8% global market share.

The US market is three times bigger than the UK. Looking at the data above, we can see how much less saturated the US market is than the UK.

You can also see the margins are much higher for the US. Salaries are much higher there.

The average margin for permanent roles is about 28%. For contract it varies from 25% - 45%. Pre-pandemic, 45% would be for hard to fill for niche roles, but post-pandemic it's around 35% for roles that were not historically considered hard to fill or niche - because of this demand for talent. In the UK it's around 15% - 25%.

The market opportunity in the US:

One of the main reasons UK recruiters love the US is that US recruiters are seen as professionals - and are a necessity to any business.

Something that drives the view of the necessity of employment in the US is 'at will employment.' This is essentially the ability of the firm to dismiss the worker without notice and without pay - and without reason. The worker is able to do the same. The worker does not have to tell the employer they've left - they can just walk out, essentially. This means a very transient market as you can see. For recruiters, this means that businesses may need support at short notice. Recruiters will often upsell contractors while they find the permanent member of staff. This is why we see that recruiters are valued.

Many agencies have done well by using their existing operational costs to test out in a new market - building out their US book from the UK. Often they'll make the most of UK clients who have US offices to build out the organic opportunity. Once it's built to a certain level, they'll look to land and expand.

The other reason to enter the US market as a recruiter...

When looking to the future to exit, if you can demonstrate competency and capability in the US market - and if you have a presence there and can demonstrate capability when it comes to both parent contracts - it leads to a higher multiple when it comes to evaluation or an exit event. This is a main driver for expansion.

So, what's it actually like to do business in the US?

The US market is incredibly strong and it's still projecting growth this year. That's the good news. However, politically, the Republicans have just taken back the House of Representatives. (As a side note, don't talk about politics with US clients).

There is now the chance of new legislation further down the line. This impacts recruiters both for perm and contract roles. And of course, the 'r' word: recession. Roles are taking longer to fill. However, there are still roles out there...

To give some context, the three indicators of a recession are: 1) job gains 2) industrial production and 3) retail sales.

In the US, across all three indicators there is strong growth, and the best performance globally.

Inflation is cooling, but the fed is continuing to raise interest rates. There were seven increases throughout 2022, and we're expecting more in 2023.

Obviously there have been loads of tech layoffs as well. We've seen that a lot of businesses have over-hired, so what we're seeing now is a rebalancing of the scales, in terms of what big businesses need post-pandemic, in order to grow. With the SME market however, there's phenomenal growth in the hiring market, particularly in the tech sector.

The FT reported that pre-pandemic, one in 10 people were contractors. Now it's one in five.

By 2027, it's predicted that up to 50% of the US workforce will be contingent in some form or another. So, people worrying about spending money is leading to an increase in contractors. Also, culturally, because of at-will employment, there’s not a huge difference between permanent staff and contractors, so you do find people switching between the two.

The US employment market:

Last year is the second strongest year on record for the US employment market.

Unemployment rate is now back at pre-pandemic levels – but there are more jobs than pre-pandemic.

What we found with our own research is that a lot of people post 60 years’ old, didn’t go back to work post-COVID. It’s because of this that the industry has suffered in terms of filling roles in this post-pandemic boom.

Where do I set up in the US?

Highest recruitment revenue per state:

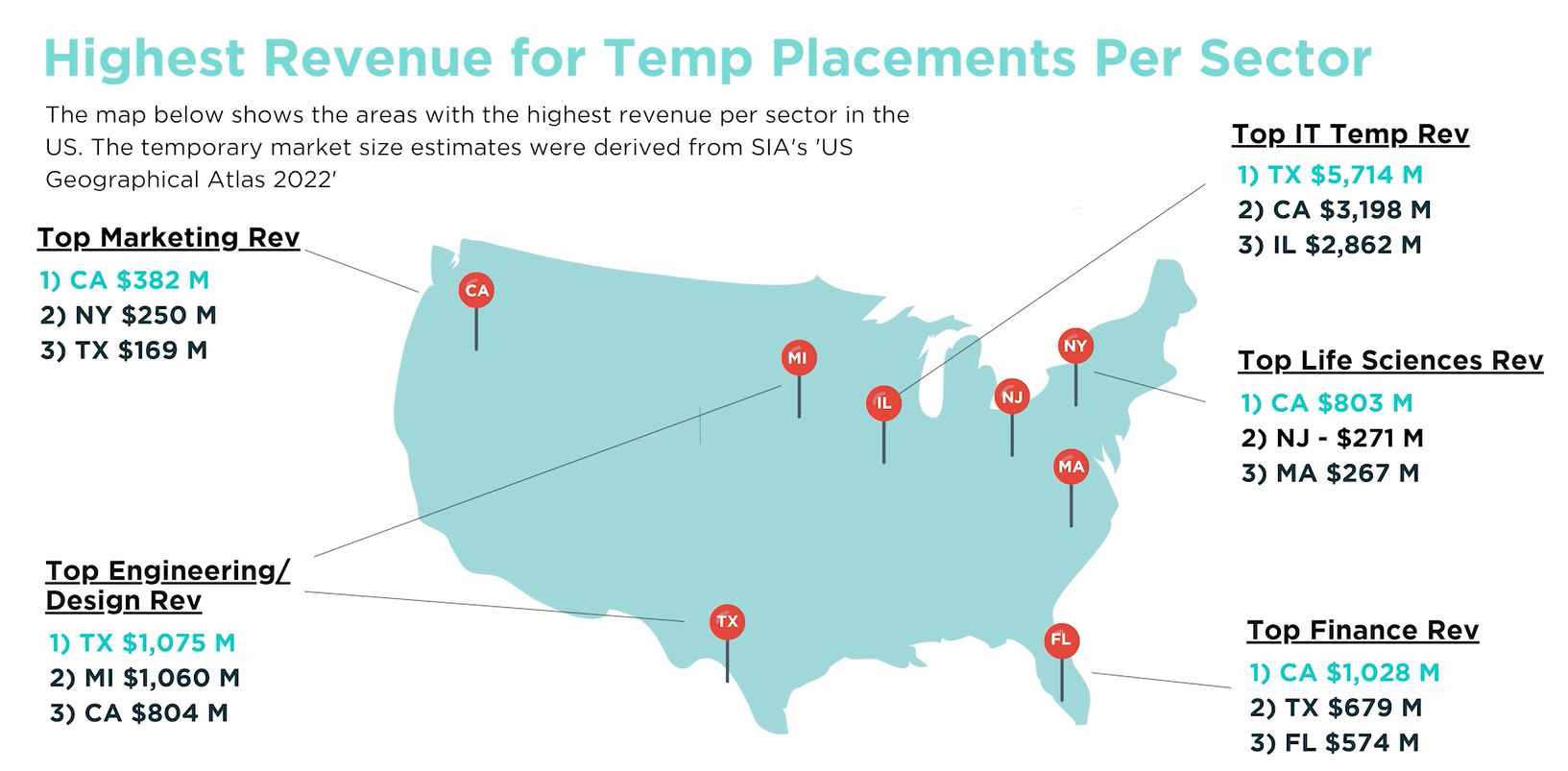

You need to think about the US as 50 countries. You can see in the visual, that the top right box shows the states with the highest total revenues coming from recruitment. This is for perm roles.

During the pandemic several states introduced corporate incentives to encourage businesses to move there. For Texas the state corporate tax is zero for example. As such, many businesses moved out to these low or no-tax states. This is certainly something to consider when you’re looking for your US HQ.

The bottom right of the visual above refer to temp contractors. There’s a slight variation. The reason this is different is because of the way that tax is paid in the US. For a contractor, the revenue is counted where the contractor is carrying out the work. Whereas if it’s a perm, it’s where the revenue is being generated from, which is the business where you’re placing the worker.

It’s good to see the split because you can see both where the companies are that are generating the revenue – but also where the talent is. It’s not necessarily in the same state.

Highest revenue for temp placements per sector:

This covers the most common sectors.

Per above, we’ve seen a massive growth in marketing and creative roles over the last 18 months…

So, how do we get a piece of the American pie?

One thing to think about is how tax legislation and culture actually works in practice. You’ve got federal law and taxes, state taxes and legislation. They can’t take away federal legislation. They enhance it. Every state does this. So, just because you do business in one state it doesn’t mean it’s going to be the same, or reported the same from one state to another – or even that you’ll pay the same tax. In the larger states e.g. California, they’ll have a local government. Potentially you’re dealing with three layers… so, it can be complex to do business in the US. You need to think small if you’re going to the US. Think about what state and where in the state you’re going to go. There are huge economies within each state. You then start to drill into reasons and drivers for each location.

Differences between the UK and US:

If the above has whet your appetite to find out more, see the full video with even more insights in the member’s section of the site.

Lastly, we finish off this article with the following quote:

Thanks for reading!

Business Rates Matters - Past, Present & Future

There’s no doubt this property tax represents a significant fixed operating cost for most recruitment firms. At this early stage of the New Year, we’ve reached a strategic point in the business rates calendar - I thought it might be helpful to outline the reasons why:

There’s no doubt this property tax represents a significant fixed operating cost for most recruitment firms. At this early stage of the New Year, we’ve reached a strategic point in the business rates calendar - James Knott, Partner at BGL Partners outlines the reasons why:

We are nearing the end of an extended 6-year 2017 Rating List

Start of the new 2023 Rating Revaluation period is in April

What makes it qualify as being ‘strategic’?

31 March 2023 represents the deadline for ratepayers to make a formal Check submission against their current 2017 list rating assessment. The significance is that a resulting savings can be backdated for up to six years, to 1/4/2017.

Draft 2023 Rating List – these draft assessments were published by the Valuation Office Agency (VOA) in late November and can be viewed via https://www.gov.uk/find-business-rates

2023 Rating Revaluation goes live 1/4/2023 – the new revaluation cycles will be 3-yearly from April. The 2023 rating list assessments are based on an assumed ‘open-market’ rental value as of 1 April 2021 (set two year before the Revaluation – compared to current assessments, which are based on an ‘AVD’ of 1 April 2015)

Duty to Notify – we anticipate a new ‘duty to notify’ reporting responsibility will apply to ratepayers for the 2023 Rating Revaluation, which will include confirming lease and rental information annually, confirming floor areas and detailing any property elements/modifications that should be assessed.

*** For more insight on the 2023 Rating Revaluation, please view our recent Business Rates Autumn 2022 Update

The strategic questions on potential savings/mitigation angles:

- Is there realistic scope/recent evidence to support a reduction in your current 2017 list assessment and/or rate liability?

- Is your new draft 2023 assessment too high, too low or about right? Importantly, there is limited scope to make a representation to the VOA to seek to amend/correct the draft list entry before it goes live on 1 April 2023…and the earlier this action is taken the better!

For those of you that haven’t already taken the sensible step of appointing a specialist rating surveyor for the new 2023 Rating Revaluation, the BGL rating team can help you with initial informal advice on your past, present and future rating position and, where appropriate, to outline recommendations on potential mitigation angles (along with a performance-related approach to any proposal).

In the first instance, please feel free to contact James Knott, one of the Partners on:

Direct Dial : 020 7183 8159

Email: jk@bglpartners.co.uk

Partnership with Skipton Business Finance

We announced last week that we have formed a partnership with Skipton Business Finance. We are really excited about this and how we can mutually serve recruitment businesses with the best resources and services possible. If you are not familiar with Skipton Business Finance, read on to find out more.

We announced last week that we have formed a partnership with Skipton Business Finance. We are really excited about this and how we can mutually serve recruitment businesses with the best resources and services possible. If you are not familiar with Skipton Business Finance, read on to find out more.

Skipton Business Finance - what we do

Skipton Business Finance (SBF) provides businesses with working capital through flexible Invoice Finance solutions, including Invoice Factoring, Invoice Discounting, LedgerLite, Headroom Facilities and our interest-free Skipton Select solution. With over 20 years’ experience, we have a business finance solution to suit any type of business, offering speed of delivery and unrivalled flexibility. With multiple locations throughout the UK, this also enables us to form even closer relationships with our clients and introducers.

We can provide working capital to a business by advancing funds varying from £50,000 up to £15m. A healthy cashflow is vital to any business and our funding solutions allow you access to working capital when an invoice is issued to your customer. The solutions we provide can be used on a confidential or disclosed, light touch or credit managed basis, but what we're really proud of at SBF is that each and every solution we structure is tailored to every single business we partner with.

A personal service

With nearly 900 active clients, we are incredibly proud of our 98% customer satisfaction rate (carried out most recently in Dec ’22). It’s our belief that we achieve this through;

A Flexible Approach to Funding – Unlike other financial institutions, we don’t base decisions on balance sheet multiples or historic financial performance alone. Our one goal is to create a solution to grow with your business - meaning you don’t have to keep going back to your funding partner, ask for increased funding, that we know can take too long.

Dedicated Account Manager – No getting passed from one department to another every time you need to speak to someone. You will speak to a dedicated account manager who knows you and your business inside out and will be able to facilitate rapid decisions to ensure you have the correct level of funding at all times.

Direct Access – We understand that running a business is time consuming and you don’t have time to be held up in call centre queues, repeating the same security questions over and over. When you call us, you get through to your Account Team – it’s that simple.

Simple Process – Every office completes their own commercial underwriting, so you’re not waiting for cross-department admin and your financial solution is processed smoothly.

Our People-Orientated Approach – Businesses often choose to stay with us for their financial needs, as and when their demands change. This is because we put you first and take the time to really understand your business’s needs.

A Building Society ethos

As part of Skipton Building Society, we share a unified ethos for client care and high-quality service. Independent from the UK clearing banks, Skipton Business Finance has the dual benefits of being part of a highly successful and long-established financial institution in Skipton Building Society, whilst retaining all the benefits of an independent. We have no expensive shareholder dividends to pay, therefore we are very much focused on understanding our clients’ business needs and assisting in creating wealth and jobs in business..

If you’d like to find out more about our Invoice Finance solutions and how we could help your business, please get in touch at info@skiptonbf.co.uk or visit our website.

2022 - US Staffing Industry in Review

Hopefully you've already signed up to come to our event on February 21st where PGC Group will be talking to us about how you can scale your recruitment business into the US. If you haven't click here and reserve your space.

Meanwhile, here's some great information and data about recruitment performance in 2022.

Hopefully you've already signed up to come to our event on February 21st where PGC Group will be talking to us about how you can scale your recruitment business into the US. If you haven't click here and reserve your space.

Meanwhile, here's some great information and data about recruitment performance in 2022.

It has been an unprecedented year for US Staffing Industry with growth hitting a record high of $212 billion according to Staffing Industry Analysts, surpassing initial projections by 13%.

As reported by Statista by the end of 2027 almost 50% of the workforce in the US is expected to be contingent. This comes as no surprise as many of PGC’s international recruitment clients operating in the US staffing have witnessed extreme growth within the temporary staffing segment within the past year, across the multiple sectors in which they operate.

With further growth expected in the US staffing industry in 2023, we thought it would be important to recap the trends we have witnessed in 2022.

Top Temporary Sectors in the US Staffing Industry in 2022

IT and Tech Sector

The IT and tech temporary staffing sector in the US was predicted to grow by 16%, to reach a projected value to reach $41.7 billion in 2022, according to SIA. To put the enormous profit making opportunity into perspective, the entire UK recruitment market is only worth $51 billion!

IT and tech is the second-largest driver of the US economy, and the North American tech sector controls 35% of the global market. So if you’re an international recruiter who hasn’t yet considered making placements in the US, why not try tech?

With PGC’s employer of record solution you can start making contract placements in any state without a US entity. Some of the best states for tech in 2022 included Texas, followed by California and Illinois. You can read more in our Top 5 Fastest-Growing USA Tech Hubs blog.

Finance and Accounting Sector

Projected to account for $9.3 billion of US staffing revenue in 2022 by SIA, the finance and accounting temporary staffing sector is expected to grown year on year by 12%. If you plan on sourcing contractors in the finance and accounting sector in the US staffing market, you can source highly skilled talent from world class universities in the US, such as Harvard. Additionally, top US states in terms of temporary staffing market size in the finance industry include California and Florida

Life Science Sector

As 2022 comes to an end, the temporary life science market in the US is expected to account for $3.7 billion of the US staffing industry, with over 98,700 new jobs projected for the next decade according to SIA.

Top states in the US staffing industry for Life Science according to SIA's 'US Geographical Atlas 2022', include California generating over $803 million in revenue, followed closely by New Jersey and Massachusetts.

Marketing and Creative Sector

The marketing and creative temporary segment of the US staffing industry in 2022 continued to experience strong growth, to total a projected $14.3 billion, a 12% year on year growth from 2021. The top areas for marketing and creative contract placements in the US staffing market included California, New York and Texas, according to SIA research.

Top Locations for Recruiting in the US Staffing Market

When entering the US staffing market, it is important to treat each US state like an individual country. This is due to each state having its own set of legislation, taxes and employment laws which differ on a federal, state, and local level. According to ASA, the top 5 states with highest staffing revenue are California, Texas, New York, Florida and Illinois.

Growing States for Contract Placements by PGC’s Recruitment Clients

At PGC, our internal data has also proved Texas and Florida are states that are growing in the US Staffing Market in 2022. According to our internal data, Texas moved ahead of New York as our second most popular state for contract placements by our recruitment clients operating in the US staffing market in 2022. Florida and North Carolina also made tractions to move up to fourth and fifth for states for most contract onboards in 2022.

We also witnessed a 12% increase last year in contract placements in Illinois. Additionally, an up-and-coming state in the US staffing market in 2022 for our clients was Tennessee, which experienced a 26% increase in contractors placed in 2022 compared to 2021 – the highest growth rate for any state in the US In 2022.

Employment Growth in the US Staffing Industry

Employment growth within the US has been ever growing in most recent years and shows no signs of stagnation with over 263,000 jobs added in November 2022, continuing from the gains in both October, and September, according to the US labor department. The unemployment rate remained at 3.7%, close to a 50-year low.

Manufacturing, professional business services, health care and social assistance have accounted for 47% of US employment growth this year and are four categories continuing to grow in the US staffing market according to the SIA.

Changes to Employment in the US Staffing Market

Pay Transparency

A major change to the US staffing market in 2022 is the increasing prominence of pay transparency laws. If you are recruiting within the US staffing market, should you advertise a job post in certain states you will need to display a minimum and a maximum salary range on every job post.

Currently California and Colorado require pay transparency with New York joining in November 2022. States potentially heading towards this change are Washington, Massachusetts and South Carolina, so it’s important to do your research and remain compliant with US employment laws per state.

US Overtime Exemption Salary Threshold Updates

US employees must be paid a minimum salary of $684 weekly, or $35,568 annually, to be classified as exempt from overtime, with limited exceptions, under the federal Fair Labor Standards Act. An increased salary threshold or white-collar exemptions has been hinted by the Biden administration, but no proposal has been published in writing yet. In the meantime, Alaska, California, Colorado, Maine, New York, and Washington have adjusted their minimum exemption salary thresholds, which is worth noting if you plan on recruiting in the US staffing market. You can find out these states' minimum exemption salary thresholds and other important updates in our US Employment Law 2023 blog.

Projections for the US Staffing Industry in 2023

In 2023, the US staffing industry is expected by SIA to grow by a further 2% and will continue to reign the title of the biggest staffing market in the world. For 2023, the US staffing industry is set to grow further but at a much more moderate rate, with the temporary staffing market set to be worth $891 billion and place and search expected to contribute $25.6 billion to the overall revenue according to SIA

Looking back on the history of the US staffing industry, and with the market surpassing initial projections by 13% early in 2022 we expect these projections to continue an upward traction beyond 2023.

If you’re a recruiter, there is no better time to enter the US staffing industry, to find out industry specifics relevant to your business objectives and how to get started, speak to one of our friendly US Expansion experts.

Member Update - January 2023

See the latest newsletter update from our MD, Paul Glynn for members of the network.

Please note, this is a personal message to Recruitment FDs members from our MD, Paul Glynn:

Good afternoon,

I don’t think it’s too late to wish you a happy New Year! I hope you had a good break over Christmas. Christmas is my favourite time of the year; everything goes so quiet on the work front – it’s the best time of year to switch off and spend great time with the family. I hope you found time to recharge the batteries too, ready for the year ahead.

I wanted to start with some very exciting news: Recruitment FDs has signed its first partnership with Skipton Business Finance!

We have worked with Skipton for several years now at Aristar Consulting and they are our provider of choice for new clients seeking invoice finance. We were first introduced to Skipton after one of the high street banks let us down with a facility for a superb public sector recruitment business we were in the process of onboarding. Our contact at Skipton turned the facility round from initial client meeting to funds out the door within 7 days and they have been delighting us with their customer service approach ever since. Their pricing is always very competitive, more importantly the day-to-day relationship and support has been exceptional. We have easy access to senior decision makers and there is always a sensible and pragmatic approach to lending.

It is important for me personally to promote brands that share the same approach to business and the same values, so I am really delighted that Skipton have joined us as we look to scale the Recruitment FDs network in 2023. You can read more about our partnership with Skipton Business Finance & Recruitment FDs here. If you are looking to review your facility in 2023, I would certainly recommend a chat with them.

After the success of our ‘Rise of the EOT and other M&A stories!’ event hosted by LinkedIn in Q3 last year, we are looking to host an event per quarter in 2023. What really resonated with me after the last event was the renewed appetite for face-to-face networking. Yes, the content, speakers and panel were great but the highlight for me was seeing so many of you in the pub afterwards making new connections and rising to my challenge of leaving the event having added at least two new FDs to your network!

We are busy working on our first event of the year, which will be about: ‘Scaling your recruitment business in the US’ alongside PGC – so whether you are a recruitment business considering your first foray into the US market in 2023 or your objective is to scale your operations in the US this year, then this promises to be a great event. The event will take place on the 21st February from 4-6pm with drinks afterwards, and will again be hosted by LinkedIn. I really liked the panel discussion at our last event so will be looking to recreate that too. If you have experience of scaling in the US and would like to be part of our panel, please let me know.

We are also considering taking our events on the road this year if there is an appetite for us to do so. We are thinking of also running the US event in Manchester. If you would be interested in attending, please let me know, and if we have enough interest, we will make that happen for you.

We will be continuing with the Quarterly Benchmarking Reports in 2023, with the website being ready to accept Q4 2022 data next week. There were no real surprises in the Q3 report data with the summer being a strong market across most areas of the recruitment sector. However, Q4 was more of a mixed bag across our client base as confidence levels dropped due to the negative press about the economy, and Liz Truss’s attempts to derail UK Plc! With over 70 recruitment businesses contributing to this report, it will become more and more useful the more businesses we have contributing. Don’t forget, if you don’t contribute you won’t receive your copy of the report!

I have been asked by several members if we would consider setting up a Recruitment FDs WhatsApp Group. I am very happy to do this – if you would like to be included, please email members@recruitmentfds.co.uk with your mobile number and I will set the group up.

Finally, I wanted to say thank you for your continued support of the network. We are looking to really scale in 2023, and as part of that we will be asking for your opinion on the direction you want the group to take, and the content areas you would like covered. Keep an eye out for emails about that in the coming weeks.

Speak soon,

Paul

Paul Glynn, founder of aristar consulting & recruitment fds

Recruitment FDs Event - The Rise of Employee Ownership Trust

On Tuesday 27th September, we’re delighted to be hosting an event focusing on the M&A market and the rise of the EOT within the recruitment sector.

On Tuesday 27th September, we’re delighted to be hosting an event focusing on the M&A market and the rise of the EOT within the recruitment sector.

Throughout 2022 we've seen a number of M&A deals take place within recruitment despite the many challenges facing us at the moment.

So, what does the market look like now, what are the benefits of EOT and how do they compare to going down other, more traditional M&A routes?

We'll be joined by Jim Fieldhouse, MD M&A at BDO and Phil Duquenoy, Partner at Key Capital Partners to get their views on the market before hearing from 3 recruitment CFOs discussing their own M&A experiences.

It promises to be a great opportunity to connect with others in recruitment finance and to learn about the various opportunities available to you.

Date: Tue, 27 September 2022

Time: 16:00 - 18:00

Location: LinkedIn, 123 Farringdon Road, London EC1R 3DA

Drinks: 18:00 - 20:00 at a nearby location TBC

Click the link below to find out more and sign up!

We know you've missed networking in person over the past few years, so we're excited to put on this event and enable you to reconnect over an interesting topic and some drinks afterwards.

We hope to see you there!

Digital Workers in work at Aristar

Digital Workers are the future of every workplace and at Aristar, the Cevitr Digital Worker (named ‘Jo’) co-works with the internal team in a key area for processing timesheet data.

Digital Workers are the future of every workplace. A digital worker (or workmate) is a software bot or software program powered by technology called Robotic Process Automation (RPA). The bots are ‘trained’ to perform key business operations on a computer, mimicking the actions of a human worker. Digital workers can take on many of the repetitive tasks traditionally assigned to business users, and quickly become experts at their assigned roles, freeing up the human workers to focus on activities that require human judgement and skill.

At Aristar, the Cevitr Digital Worker (named ‘Jo’) co-works with the internal team in a key area for processing timesheet data. This enables Aristar teams to process payrolls accurately and on time. Jo, twice daily, accesses timesheet systems from third-party agencies that Aristar works with, fetches the timesheet information for multiple individuals whose payroll needs to be processed and keys in the latest entries into the Aristar internal portal.

Jo also keeps track of every action performed with a detailed status of the outcome from the action. The email report of the actions is sent to key business users at the end of the process run by Jo, and this enables the business to focus on exceptions that require human interpretation. Jo currently performs the process for 5 agencies and the entire process takes around 90 minutes a day. This saves the business critical time and also ensures the right coverage during holidays or sickness. Besides this, Jo augments the Aristar team to offer its clients an effective service.

Cevitr enables organisations of all sizes to take advantage of world leading RPA technology powered Digital Workers with a simple, affordable business model and an unrivalled service wrapper. With the Cevitr model, businesses can adopt Digital Workers in a matter of weeks–literally 2 to 3 weeks from ideation to deployment of a Digital Worker.

Deploying the Digital Worker requires no change to existing systems or processes. Digital Workers also work 24/7 and have amazing speed and accuracy. The Cevitr managed service delivery is backed by a disruptive commercial model on an all-inclusive subscription basis with zero upfront investment required.

Paul Glynn, a key sponsor of the initiative from Aristar, remarked, “Jo has freed up valuable time for the team to concentrate on more value-added tasks, enabling the provision of an even better service to our clients.”

Please get in touch with Cevitr at info@cevitr.com for any information or just an informal chat on the possibilities with a Digital Worker!

How CFO’s Can Re-engage Revenue Generation

Many CFO’s will find it has been a challenging time this past year, with COVID and BREXIT impacts on UK firms. These may have caused changes in staffing levels and operating budgets, driven the transformation agenda disrupted priorities.

Many CFO’s will find it has been a challenging time this past year, with COVID and BREXIT impacts on UK firms. These may have caused changes in staffing levels and operating budgets, driven the transformation agenda disrupted priorities. With so much to content with their can often be a tendency to rein in any investment spend and to retreat and defend the status quo business position.

However, in such times finance is often the foundation the business looks toward to get them safely through troubled waters. This leads to high pressure on the finance function, but also presents opportunity to showcase how finance can impact value creation in the company.

The tumultuous past year has demonstrated how it is difficult to control or predict outside uncontrollable events. The key now is creating flexibility in the business and driving proactive recovery and engagement. To rebuild the team and culture and focus the business on the now and forwards, on what needs to be done to get the revenue moving again in a positive direction.

With finance looked to as the foundation of the business, the area that is informed and pragmatic, CFOs are well positioned to rebuild the culture throughout the organisation and be a driving force to recovery. Many staff have felt disheartened and are even reporting PTSD like symptoms from the WFH impact. Whether you plan to return to the office, adopt working remotely or a mix, getting the team back to productivity is key as is engaging them together.

The biggest impact on the organisation right now is a degradation of incoming revenue; sales bookings, candidate placements and an increasing build in pipeline is essential to give confidence across the business and to revitalise the comradery between staff and teams through having both more to work on together and a more positive outlook.

One way many organisations are approaching this is to look for tools that re-engage their staff, that drive productivity back up for both office and remote sellers/recruiters and to introduce an element of fun that has been lacking. Having people forced to talk on team web calls during Covid is one thing, but unforced engagement across the team on real activity works far better.

An easy, affordable way to bring this to your team found my many during COVID is OneUp Sales. Quick to switch on and integrated with 27 existing systems to bring your existing real data to life quickly for your team, it enables you to easily set, share and manage activity KPI’s; to run league tables and run competitions at individual or team level on revenue and other key metrics. Visibility can come through clear dashboards, MS Team alerts, automated daily summaries to the team members AND rich graphical TV screen displays ensuring all across the business are on the same positive page to what is expected and what is happening.

“When your team is working from home it really makes one hell of a difference. With no effort you can see what your team are spending their time on without having to ask questions or run tricky reports. Stats went through the roof.” Lewis Bunn, Freight Appointments

“OneUp has improved the unification and celebration with everyone getting the recognition they deserve. It has genuinely helped celebrate every aspect of the business.” Alex Pitts, Applause IT

Find out more at www.oneupsales.co.uk or reach to ian.moyse@oneupsales.co.uk

Helping the Recruitment Sector Prepare for the ‘New Normal’

As the UK enters its second month of a complete lockdown, many organisations are starting to think about the steps they can take now to get their recruitment agency in best shape for when the country returns to ‘normal’ (whatever that will look like).

Written by Rachel Allen, Marketing for Evertime by EdenGroup

As the UK enters its second month of a complete lockdown, many organisations are starting to think about the steps they can take now to get their recruitment agency in best shape for when the country returns to ‘normal’ (whatever that will look like).

The Recruitment and Employment Confederation has been a valuable source of information for Evertime and having listened to their Talking Recruitment webinar today (29.4.2020) we were very impressed at the amount of work they have been doing to support recruitment agencies during the Coronavirus crisis.

Neil Carberry, the chief executive of the REC, and his colleagues are liaising directly with the team at No 10 and the Treasury on a daily basis and they have been resolute in their need to have very clear guidance for their members. Although schemes have been put in place to get cash out to businesses who need it as quickly as possible, the guidance needs to be in place so that recruitment agencies aren’t audited in 3-4 years by the Treasury and required to pay back large sums of money. The REC has done a great deal of lobbying to the government about the recruitment sector’s needs and they feel that the understanding of the recruitment sector by the government is at the highest level ever.

The REC asked for four things to help the recruitment sector to get back on its feet:

1. Focus on cashflow

2. Fund Statutory Sick Pay for Workers

3. Help recruiters to help critical sectors

4. Help people to find work quickly and safely

The REC talks about the fact that we are now in a government-enforced recession, which has been created for valid public health reasons. For that reason, they have been very supportive of the government’s decision to delay IR35 until 2021, but they predict that chancellor Rishi Sunak will want to review how the self-employed are taxed, especially given the comments he has made about the support available for directors of limited companies.

We don’t want to publish information or guidance on the Evertime blog because the situation evolves and changes on a daily basis, however, would urge you to look at the official sources. You might want to head over to the REC website to find out more about:

· Temporary measures put in place around DBS checks, Right to Work and face to face interviews

· Business rate exemption for employment agencies (not initially included)

· Gangmasters and Labour Abuse Authority granting temporary licensing

· Clarity on JRS functions for agencies

The REC team spoke on the webinar about the various options available to help businesses including:

· Deferral of VAT payments until 30 June

· Guidance around Statutory Sick Pay

· Job Retention Scheme (Furlough)

· Coronavirus Business Interruption Loan Scheme. There are 40 providers available and the REC suggests you visit the British Business Bank website for more advice. There are different types of loans available, so it’s worth doing research about the options that are available.

· British Business bank also has a section on their website for large businesses. The REC guidance suggests that if you have applied for help before, but were turned down, it’s worth trying again because some people have been successful when applying a second time.

· There is an option to apply for more than one of the schemes available. You will obviously need to be certain that you qualify (which is why the REC has been calling for clear guidance).

· Coronavirus Bounce Back loans are available so that SMEs can borrow up to £50,000.

· If you are exempt for paying small business rates, you can apply for a grant via your local authority.

· Covid Corporate Financing Facility (CCFF) is also available.

The advice is being updated regularly as the situation evolves, and the REC’s view is that the government will apply monthly extensions to the various schemes, so it is worth keeping up to date with the help that is available.

We would highly recommend tuning in to these webinars, especially as it was accessible to non-REC members as well. The next Talking Recruitment webinar is on 19 June and you can book future webinars here. If you want a copy of the slides, please email bstanding@edenoutsource.co.uk and we can get a copy sent over for you.

Evertime is the game-changing, brilliant Pay & Bill SaaS solution with brilliant timesheet management capabilities that will power your business growth.

Evertime unleashes the full potential of your business to rapidly accelerate revenue growth without having to upscale your back office whatsoever.

The most complete, compliant, end-to-end contractor Pay & Bill solution available, Evertime harnesses the power of the cloud to transform your entire back office activities.

Visit Evertime’s partner page to view their exclusive Recruitment FDs' member offer

Pay Exchange

David Earl, Business Development Manager of Cambridge Global Payments highlights the challenges of working across currencies.

It is becoming more and more frequent for UK based recruiters to expand into global markets. Here at Cambridge, we have spoken to a number of businesses who face challenges when it comes to Foreign Exchange and highlighted some considerations to make when venturing overseas.

David Earl, Business Development Manager of Cambridge Global Payments highlights the challenges of working across currencies.

It is becoming more and more frequent for UK based recruiters to expand into global markets. Here at Cambridge, we have spoken to a number of businesses who face challenges when it comes to Foreign Exchange and highlighted some considerations to make when venturing overseas.

To begin with, the challenge. Let us say you invoice a customer $200,000 with 90 day payment terms.

On day one, you use the market rate of 1.2500 to work out your equivalent revenue in GBP.

$200,000 @ 1.2500 = £160,000

However, by day 90, when they pay, the rate of exchange has moved to 1.3000.

$200,000 @ 1.3000 = £153,846.15

Revenue depreciation : £6,153.85

How can this be managed better? Here are four points for to consider when you address expanding into global markets.

1. Accept payment into the correct currency account

Even in this day and age, it is still common for businesses to accept a foreign currency into their GBP account. The charges applied to this can be substantial, commonly at 3-4 per cent by the Bank. When our clients move into new international markets, Cambridge have over 30 currency accounts which they can utilise when accepting foreign currency revenue. At that stage the business has the control of the conversion, generating a substantial cost saving and allows you to convert the funds as and when it suits you best.

2. Check how broad your provider’s FX product portfolio is

Check what type of FX products they offer. Having access to a broad portfolio of FX solutions may be important if you want to develop a robust hedging strategy. If your needs are fairly simple, you may only need access to spot transactions. However, if you are a larger business with more exposure to currency, a range of products could be important.

3. Keep focus on the FX losses on your balance sheet at the end of the year

The foreign exchange (FX) market can be volatile and some days you may see market move by one per cent or more. If you begin to pay a supplier or receive from a customer the foreign currency equivalent of £100,000, a one per cent move in the market would make a £1,000 difference to the cost or sale. Most businesses don’t have the time or resource to monitor the currency market regularly or the knowledge to protect themselves against market volatility. There are a number of currency market specialists that you can speak to for help. There is also a range of products that allow you to fix the FX rate including forward contracts and structured products.

4. Consider having a look into your provider’s international payment capabilities

Not all FX specialists offer the ability to send third party payments. If you need this option, it may make sense to work with a provider who can facilitate currency exchange and send funds on your behalf. Not all providers can send funds to all destinations in all currencies. If your business makes payments to exotic destinations in emerging market currencies, check that your provider can do this. Some providers will have specialists with expertise in exotic currencies.

Working in foreign currencies can be complicated and without special care can lead to losses as the currency markets shift. Taking advantage of dedicated services in this area can mitigate these risks and make any foreign expansion worth so much more.

Cambridge Global Payments is a leading provider of integrated cross-border payment services and currency risk management solutions. As a trusted partner for over 25 years, Cambridge delivers innovative solutions designed to mitigate foreign exchange exposure and address unique business needs.

Visit Cambridge Global Payments’ partner page to view their exclusive Recruitment FDs' member offer

Is this the end of the office era?

The past month has been a rollercoaster of change in light of the COVID-19 pandemic. One of the most prominent transitions is that of working from home instead of in the office. The UK has adapted to remote working well, given the circumstances; many able businesses have introduced new remote processes and employees have established new ways of co-working. Adoption of remote working solutions is through the roof; Microsoft saw a 25% increase in Microsoft Teams usage in the first week of lockdown, and meeting minutes hit 2.1 billion in a single day on the 31st March.

The past month has been a rollercoaster of change in light of the COVID-19 pandemic. One of the most prominent transitions is that of working from home instead of in the office. The UK has adapted to remote working well, given the circumstances; many able businesses have introduced new remote processes and employees have established new ways of co-working. Adoption of remote working solutions is through the roof; Microsoft saw a 25% increase in Microsoft Teams usage in the first week of lockdown, and meeting minutes hit 2.1 billion in a single day on the 31st March.

Millions of people have also started to take advantage of remote working to improve their wellbeing; taking family walks during their lunch hour, making healthier meals and finding innovative ways to exercise... everyone is talking about Joe Wicks!

It seems that remote working, and the flexible benefits that come with it, is being embraced as the ··new normal". But the big question is, will things ever go back to the "old normal?" Or will normal mean something different when the COVID-19 pandemic is over?

Indeed, it looks like mass remote working is, in some capacity, here to stay. Consulting firm Global Workplace Analytics' president Kate Lister predicts that within the next few years around 30% of people will be working from home a few days a week. Quoted by vox.com, she added that there has been demand by employees for greater work-life flexibility and now employers have had a chance to see the light.

Remote working offers huge benefits to both companies and employees; reduced overheads and office rental costs, no office commute, a flexible schedule, and a more personalised work environment - to name a few. It's likely that the use of hot-desk spaces and huddle rooms will increase, enabling employees to collaborate in person only when they really need to. Flexible working options like this offer opportunities for increased productivity, backed up by a poll (The Independent ) last year surveying employees who had flexibility in working time and location.

Despite the clear benefits of remote working, there are major downsides. Less people in the office means vacant infrastructure that would need to be repurposed. And, the physical proximity that co-workers gain in the office just can't be matched virtually; physical interaction within a designated space can create a sense of team and community that many businesses might struggle to maintain at a distance.

Whether you are for or against remote working long term, the world has changed in light of the COVID-19 crisis. When the storm passes, “normal” won't be the same as we knew it; even if the change is only in perspective on how to improve office spaces and work more flexibly.

Next steps

If you'd like more information about how SynergyGroup can help you to future-proof your business, or any of the other solutions we offer, you can contact any of the SynergyGroup team on 0800 915 6666 or email myteam@synergygrp.co.uk

Visit the Synergy Group partner page to view their exclusive Recruitment FDs' member offer

7 Top Tips for Working from Home

While most working from home tips are concerned with how you work, we often overlook where we’re working. However, our work environment is a key factor in how much we can get done in a day.

Francis West shares 7 top tips for working from home.

Recruitment FDs partner, Westtek Solutions is a cybersecurity specialist providing proactive and strategic technical advice and IT support to SMBs.

Written by Francis West, Westtek Solutions

While most working from home tips are concerned with how you work, we often overlook where we’re working. However, our work environment is a key factor in how much we can get done in a day.

Some things to think about include:

· What sort of lighting is best?

· How about temperature and air quality?

· What chair and desk should we use?

· Should we listen to music or work in silence?

· What about office pets?

AND

· What online security do we need?

Tip 1: Get rid of the clutter (both physical and digital)

If you can’t see the surface of your desk (or your computer desktop) it’s probably going to be difficult to work.

According to neuroscientists at Princeton University, physical clutter in your surroundings compete for your attention. This can lead to decreased performance and increased stress.

To clean up your workspace start with these suggestions:

· Become selective about what you accumulate. Ask yourself: Will this really add value?

· Clear out any digital tool that doesn’t bring you high value. Delete everything and only add back valuable ones.

· Conduct a monthly review of your space: Set time aside to clean, sort, and discard your physical and digital clutter.

Tip 2: Design your work environment for willpower

Our brains are lazy, and the choices we make often come down to a matter of convenience. This means that whatever is nearest to you—your phone, social media, TV—will be harder to block out.

You’ll be less likely to do things you don’t want to if you make them less convenient. This could be as simple as putting your TV remote in a drawer when you’re working. Or keeping snacks in the kitchen.

Tip 3: Music vs. silence in your work environment

Research shows that silence is the best option for an optimal work environment. But noise doesn’t have to be a deal breaker. Either find a place with a suitable level of volume, or pick the right music for the right task.

Tip 4: Should pets be in the office?

There are 2 sides to the argument

The good:

· Pets can reduce our stress

The bad:

· Pets can of course be another form of distraction either through unwanted noise, smell, or wanting your attention

In the end, having pets in your work environment comes down to personal preference and the people you work with.

Tip 5: Bring a bit of nature into your work environment

Adding more natural light is one of the quickest ways to improve your work environment.

Along with light, fresh air can also have a direct positive impact.

The final natural element you’ll want to be sure to include is nature itself. Surrounding yourself with plants can help alleviate mental fatigue.

To be more productive, try to bring all three into your work environment: Light, fresh air, and nature.

Tip 6: Look for quality office furniture

Although the thought of working on the couch or on your bed may sound attractive, your back and neck won’t thank you for this. Depending on the amount of space available, consider purchasing a large desk, bookshelves, and a comfortable office chair.

You don’t have to go top of the line but remember, the point is that you will be working in this space every day. So it needs to be comfortable and functional.

Tip 7: Stay Vigilant Against Security Threats

Just because you’re not in the office doesn’t mean you’re not a target for hackers. Your work machine is incredibly valuable for thieves and criminals, so take care to work securely.

Be aware of your company’s network policies such as the use of Wi-Fi, personal devices, and more. Ask if you are not sure.

Be alert for any documents or links sent to your inbox. Don’t click something that looks strange or suspicious.

Use a business-grade Virtual Private Network (VPN) for encryption.

Close your room’s door to avoid disclosing sensitive information to family members or visitors. Children especially hear and repeat everything.

Working from home can be a pleasant and enjoyable experience if you think things through and plan properly. Contact Francis.W@westtek.co.uk if you have any questions about cybersecurity or working from home for friendly expert advice.

Visit the Westtek partner page to view their exclusive Recruitment FDs' member offer

Is your business COVID-19 ready?

Do you know which way to turn if COVID-10 causes a lockdown or if your staff are told to self-isolate?

Staff are unable to work from home effectively if everything they need if office based.

SynergyGroup can support your organisation’s IT, security and 3rd party application requirements during this period.

Do you know which way to turn during the COVID-19 lockdown or if your staff are told to self-isolate?

Staff are unable to work from home effectively if everything they need if office based.

The effect on your business could be catastrophic.

You need to have a plan of action!

Ø Having accessibility tools helps in creating an all-inclusive workplace for users with vision, hearing, mobility and mental health difficulties. These tools are pertinent in the context of the COVID-19 outbreak too.

Ø We must create a solution for those in isolation to continue to work seamlessly.

Ø We also need a solution in the event that the office is on lockdown

Ø We must enable collaboration and productive working to continue

Collaboration tools such as Microsoft Teams will bring your business through these challenging times. You may well have the Microsoft Teams license as part of your current licensing package.

Microsoft Office 365 is a cloud-based service that combines the familiar Office desktop suite with Microsoft’s next-generation communications and collaboration software to help organisations meet their needs for productivity, mobility, and security. With a top-of-the-line set of productivity tools, it offers the complete Office experience with services integration for your PC, Mac, and mobile devices, so users can be productive from virtually anywhere. Microsoft Office delivers the power of cloud productivity to businesses of all sizes, helping save time, money, and free up valued resources.

We can help you to set this up as pain free as possible.

If you need assistance in getting your workplace ready, please get in touch and we will book you a slot with one of our engineers to show you how.

You can contact us on:

0800 915 6666 or myteam@synergygrp.co.uk

Visit the Synergy Group partner page to view their exclusive Recruitment FDs' member offer

IR35: Where are we now?

With less than 2 months to go before the new rules are due to come into force for the private sector on 6 April, businesses that use contractors have a limited window of opportunity to prepare for the new compliance burden.

Recruitment FDs Partner, Mischon de Reya have helped a number of clients with reviewing their contingent workforce arrangements and can provide advice on this topic.

Written by Sarah Hein, Mishcon de Reya LLP

With less than 2 months to go before the new rules are due to come into force for the private sector on 6 April, businesses that use contractors have a limited window of opportunity to prepare for the new compliance burden. Confusingly, the draft legislation remains subject to consultation, both in the House of Commons (although resolution is expected soon) and in the House of Lords (this is likely to run for longer). We do not expect to have certainty until 11 March when the Budget is due to confirm that the new rules will come in from 6 April.

From 6 April, end users of contractors will be obliged to determine whether each and every contractor it engages is either inside or outside IR35 (i.e. should they included on the payroll or not?). The person in the chain of contracts who is immediately above the contractor's personal service company ("PSC") (often the recruitment company) will be responsible for operating PAYE and accounting for income tax and national insurance contributions (NICs) to HMRC. HMRC estimates that more than 90% of contractors do not currently apply the tax rules correctly and expect to receive significant additional tax once these rules are up and running. This suggests there must be significant extra costs to the private sector. Employers' NICs, at 13.8% will be a significant extra cost for the supply chain, and cannot generally be passed on to contractors.

How are these being dealt with in practice?

You may have seen that 30 contractors from Thomson Reuters have recently come out to negotiate as a group in respect of their post-April 2020 working agreements. The contractors are unhappy that Thomson Reuters have not yet confirmed their status and that their net pay will fall if they are deemed to be inside IR35. They claim they will lose 45% of their gross pay and demand a 35% pay rise each in order to be moved on to the payroll.

The Financial Times reports that Deutsche Bank is likely to lose 50 out of 52 workers in their London based "change management" team who specialise in efforts to prevent global financial crime. It remains to be seen whether these projects will be able to complete as originally planned and budgeted or will take place at all. Deutsche is one of the many banks that has decided not to work with contractors post-April and to either use workers on payroll or dispense with the services of contractors.

What does this mean for you?

All of this goes to show how important it is to keep your contractors in the loop and happy with the situation as it progresses, or else risk them walking off projects. The potential disruption of contractors leaving a project halfway through is significant and each affected end-user business will need to be mindful of their own contractor profile.

We encourage all end-user clients (other than small companies who are exempt from the new rules) to review the contractors they use currently and consider what the likely payroll implications of their current working practices will be post-April. Then they need to decide what approach they wish to take in relation to their contingent workforce and then engage as early and in as much detail as possible with their contractors in the hope that this can be amicably resolved before the April deadline.

We have helped a number of clients with reviewing their contingent workforce arrangements and can provide advice on this topic.

Mishcon de Reya have a leading UK Recruitment Services Group made up of recruitment specialists from their corporate, employment and litigation practices. A number of their legal specialists have advised on sector specific issues for over 20 years.

Their clients are both bricks and mortar and platform based, ranging from start-ups and SMEs to major international players.

They offer a full service of contentious and non-contentious legal advice, including regulatory and corporate and employment and commercial contracts, as well as international expansion, data protection, cyber and immigration. This is what sets them apart from their closest competitors

Visit the Mishcon de Reya partner page to view their exclusive Recruitment FDs' member offer

3 ways Purpose can be more than just a slogan

Why am I adding yet another article to the ‘purpose’ pile? Because, working in the Purpose Industry, I am worried that a lot of people are missing the point entirely.

So called ‘purpose statements’ are being rolled out by lead teams, marketeers and PR agencies across the land as the next buzz words designed to eek out a drop more commitment from their people … deep down you know that won't work, right?

Written by Amit Zala, Co-Founder at Fieldwork

Why am I adding yet another article to the ‘purpose’ pile? Because, working in the Purpose Industry, I am worried that a lot of people are missing the point entirely.

So called ‘purpose statements’ are being rolled out by lead teams, marketeers and PR agencies across the land as the next buzz words designed to eek out a drop more commitment from their people … deep down you know that won't work, right?

But before you let the power of purpose pass you by, here are some words on how to do it well and reap the rewards for everyone.

We have all been there, that painstaking feeling that the business we founded or work in is just not where we want it to be. We can see the potential. We can smell it, touch it and taste it. But for some reason no one can put this potential into words. No one can make it feel tangible and achievable.

So we try. We get our best creative minds together and we come up with feel good, trendy, statements that are nice to look at and suit our branding. Time, money and energy are poured into creating purpose, mission, vision, values statements that rarely provide a return on investment.

At best inert, at worst divisive, these statements can leave the employee community feeling disconnected due to their lack of involvement in their creation. Seemingly positive and powerful statements, if not brought to life and used to their full potential, can serve as a constant reminder of an ambition the organisation is not living up to and create a palpable sense that nothing here is true.

Each business that created guidance statements (and didn't use them) missed an opportunity to step towards the future that everyone wanted. As specialists working in this field we know that it’s not a lack of genuine desire for transformation that thwarts the leader’s efforts. It's actually just the lack of knowing a better way.

The solution is found when businesses learn-by-doing, to discover, land and use their Purpose, with a capital ‘P’, to evolve beyond the conventional.

At Fieldwork we spend our time supporting organisations who are embarking on doing exactly that. This is the first piece in a series that we hope will capture what we’ve learned on the journey of helping businesses and organisations use Purpose as a transformation tool that evolves the business to its next level.

What is Purpose?

Purpose

/ˈpəːpəs/

noun

the reason for which something is done or created or for which something exists.

[Oxford English Dictionary]

“But hold on!” I hear you cry “If this is the definition of purpose, the purpose of my business is simple ... To make money!”

However at Fieldwork we would always challenge this. When the majority of businesses started, the founders almost always held a strong desire or passion for whatever opportunity they had identified, whatever service or skill the world needed that they had to offer. It was this passion or desire that lit the founding fires of their business and it was from these beginnings that the initial creativity and energy of the business emerged. It is in these fires that we find some of the vital pieces of the jigsaw puzzle that help bring Purpose to life.

Purpose can be found in the sweet spot between these puzzle pieces that so clearly indicate what you love doing, what you’re good at, what the world needs and what you can be paid for.

The Japanese refer to this sweet spot as ‘Ikigai’ meaning ‘a reason for being’. It alludes to the value in contributing and making work worthwhile.

Ikigai reminds us that some of these pieces are present in any business, lying dormant and waiting to be brought to life.

Purpose In Action

Here are 3 simple things Purpose can be in the service of transforming your business:

ONE: A Tool that Transforms your Current Culture to a Culture of Innovation (and makes people happier)

There’s nothing worse than the daily walk past the statements on the wall. The daily reminder of where you know the business could be headed. This doesn’t transform culture and make people happy. Quite the opposite.

However, when Purpose is found deep within the origins of the organisation, surfaced and shared with the whole organisation with care and diligence, then immediately everyone feels connected to it and clear on how they can contribute to bringing it successfully to life.

So how does bringing Purpose to life link to transforming company culture?

One key aspect is that it enables you to bring focus to areas that need more attention.

To illustrate this we’ll use the example of a client we’ve been working with for the past few years. One of the reasons we’ve always enjoyed working with them is that they are young, vibrant, fun, engaging and innovative. These attributes make them unique and attractive to work for and successful to work with, but from their position inside the business it's not so easy to see this.

In completing the work required to rediscover their Purpose and bring it to life, it helped them see how engaging they were internally and how that impacted on their clients and their work.